Wyoming LLC Formation Steps: Step-by-Step Instructions [ 2025 guide]

Creating a Wyoming LLC is one of the most appealing legal structures for protection, flexibility, and tax benefits. With low cost, strong confidentiality laws, and free-enterprise Climate, Wyoming is entrepreneurs' and small business owners' favorite.

In this post, I am going to walk you step by step through how to form an LLC in Wyoming so that you can be sure to have your business based here in this state.

You are a new or seasoned investor, and this guide will be useful and easy for you.

Why Wyoming for Your LLC

Below are the reasons why thousands of businesses create Wyoming LLCs annually, before we move to steps:

- No corporate or individual profit state income tax

- Lowest annual fees and filing fees

- Strategically designed protection legislation

- No required public disclosure of owners

- Pro-business regulatory environment

Whatever business venture you are interested in pursuing, be it an e-business company, a consultancy firm, or a real estate investment company, Wyoming's door is open for your company.

Step-by-Step: Creating an LLC in Wyoming

1. Select a Distinguishable Name for Your LLC

- Your LLC can't be the same name as other companies listed in Wyoming but must contain the suffix "Limited Liability Company," "LLC," or "L.L.C."

Tip: Check name availability on the Wyoming Secretary of State business search tool

- Having trouble thinking of a business name and naming it? LLC Setter will name it for you.

2. Get a Registered Agent in Wyoming

- Wyoming does make it a requirement that all LLCs have to have a registered agent who resides in the state.

- This individual or corporation will accept legal and tax mail in your name.

- You can do this yourself, but most small businesses have someone place a professional order like LLC Setter so that it's all confidential and so that they don't lose the critical documents.

3. File the Articles of Organization

- Optional, but the formal document that gets your LLC on the state books.

- File online or by mail with the Wyoming Secretary of State

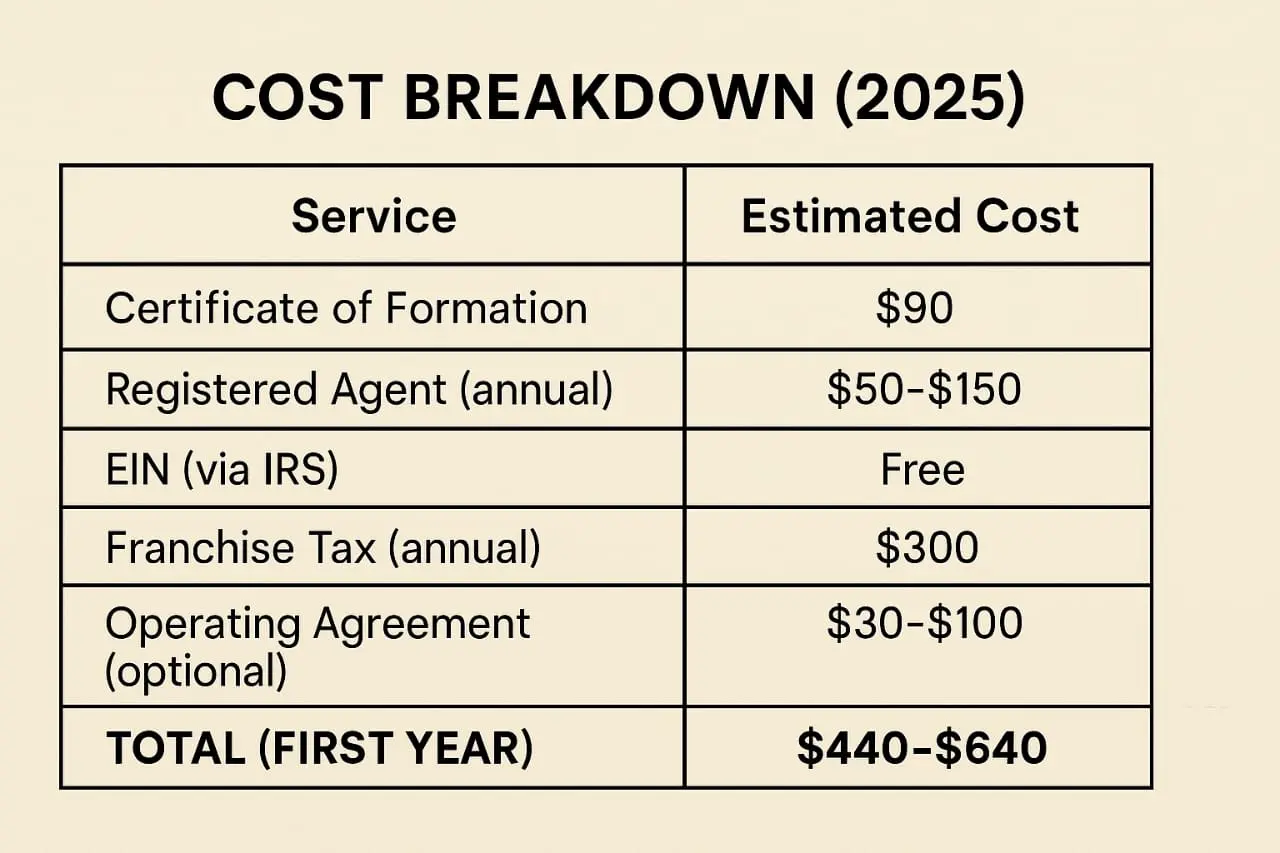

- Pay a $100 filing fee

- Provide your LLC name, registered agent details, mailing address, etc.

More labor-intensive and more forms to fill out- LLC Setter will do all the forms for you efficiently and correctly.

4.Create an Operating Agreement (Optional)

- Optional but helpful when figuring out how your LLC is going to run its business. It sets ownership, member responsibilities and rights, sharing of profits, and much, much more.

- It's particularly handy if you're more than one member or anticipate having investors.

- No time to fuss creating those annoying legal papers yourself? LLC Setter includes a pre-formatted, editable Operating Agreement.

5.Obtain an EIN (Employer Identification Number)

An EIN, or Federal Tax ID, is required to:

- Open a business bank account

- Hire employees

- Pay federal income taxes

- You can obtain one free from IRS—though if you simply don't feel like fiddling with IRS for LLC Setter will obtain your EIN for you in an instant.

6. Stay Compliant: Annual Reports & Business Licenses

- Annual Report: Wyoming LLCs must file an annual report and pay an annual fee of $60 (and extra fees if you own something of value).

- Business License: Depending on your business type and city, you will have more city permits or licenses.

Stay compliant—LLC Setter provides full compliance management services.

Wyoming LLC Formation Benefits

- Protects your personal assets from business risks

- Is tax flexible (can be treated as a sole proprietorship, partnership, or S Corp)

- Conceals ownership information

- Ideal for start-ups, e-businesses, and real estate investors

Ready to take advantage of these benefits? LLC Setter is your one-stop-shop to establish a secure, compliant Wyoming LLC.

Wyoming LLC FAQs

- Do I need to reside in Wyoming to form an LLC there?

No. You can be in any location within the United States or even internationally and still form a Wyoming LLC.

2. Can I utilize a virtual address?

You can use a mailing address for mail, but the registered agent must be in Wyoming in person. LLC Setter does provide a compliant address with their service.

3. How long does it take?

It usually takes 1-2 business days for most Wyoming LLCs to be formed when they are filed online. Paper filings are slower.

Conclusion:

- Start Your Wyoming LLC with Confidence Creating an LLC in Wyoming is the best method of securing your business and having less taxation.

- It can be easy, quick, and affordable using consulting appropriately.

- Rather than dealing with forms, jargon, and compliance law yourself, let us handle it for you.

✅ Get Your LLC Off to the Right Start with LLC Setter

We help business owners like you:

all 50 states, including Wyoming

- Fill out all of the paperwork, submissions, and IRS procedures

- Remain compliant annually

Ready to create your Wyoming LLC? Just click on over to LLCSetter.com and start today