Best State to Start an LLC in the USA – Which is the Best to Choose?

If you are considering business in the USA, one of the most important decisions, do it in which state do you establish your LLC? Each state is different, with its own laws, tax benefits, and enforcement of the law. In this blog, we will be talking about what is an LLC, for what kind of businesses it is most appropriate, its pros and cons, taxation details, and how to choose the optimal state for your LLC.

What Is an LLC?

An LLC (Limited Liability Company) is an American business structure that protects personal assets. If the company is in default on debt or being sued, your personal assets do not get in the way. It's a combination of the corporation and partnership formats, with the advantages of both.

How to start US LLC from anywhere in the world: for beginners

Advantages of LLC Formation:

- Limited Liability Protection

- Pass- Through Taxation

- Flexible Management structure

- Fewer Compliance Requirements

- Credibility and Trust

- Flexible Profit Distribution

- No ownership Restriction

- Easy to form and maintain

What Kinds of Businesses Are LLCs Suitable For?

1. Freelancers & Consultants – Writers, designers, programmers, etc.

2. Small Business Owners – Local firms, services, online sellers.

3. Real Estate Investors – Investing in rental properties.

4. Startups – Looking for flexible ownership structures.

5. Family-Owned Businesses – Joint ventures among family members.

6. High-Liability Businesses – Construction companies, manufacturers, etc.

Pros and Cons of an LLC

✅ Pros:

- Limited Liability Protection

- Pass-Through Taxation (No double taxation)

- Flexible management structure

- Low compliance burden

- Professional appearance with "LLC" in name

❌ Cons:

- Limited life (in some states)

- Subject to self-employment taxation

- Less simple to raise venture capital

- Setup mistakes affect liability

LLC Tax Basics

Single-Member LLC:

- Default is sole proprietorship.

- Income reported on personal tax return (Schedule C).

- LIABLE for self-employment tax.

9 Tax- free states to form a US LLC: in-depth guide

Multi-Member LLC:

- Default is partnership.

- Must file Form 1065 and pass out Schedule K-1 to members.

Optional Tax Designations:

S Corporation (S-Corp) –

Can pay owners a salary + dividends (save taxes).

C Corporation (C-Corp) –

Double taxed but may best option for big businesses.

Why does the states matters?

Each states has their own rules for LLCs because some states are cheaper , some gives privacy, and some better for startup and remote businesses that's why choosing a right states for forming an US LLC because they save your money and give you better legal protection , are you interested forming an LLC in Particular states LLC Setter make Easy this process see Our Pricing

How to Choose the Best State to Incorporate an LLC?

Most Significant Considerations:

- Where You're Based – Even if you don't, you may still be required to register there anyway.

- State Taxes – There are some states (e.g., Texas, Florida) which have no personal income tax.

- Filing Fees & Court Fees – Vary wildly from state to state.

- LLC Laws & Protection – Delaware and Wyoming both have strong protections.

- Privacy Statutes – Anonymous ownership allowed in a few states.

- Investor Preferences – Large investors and VCs like Delaware.

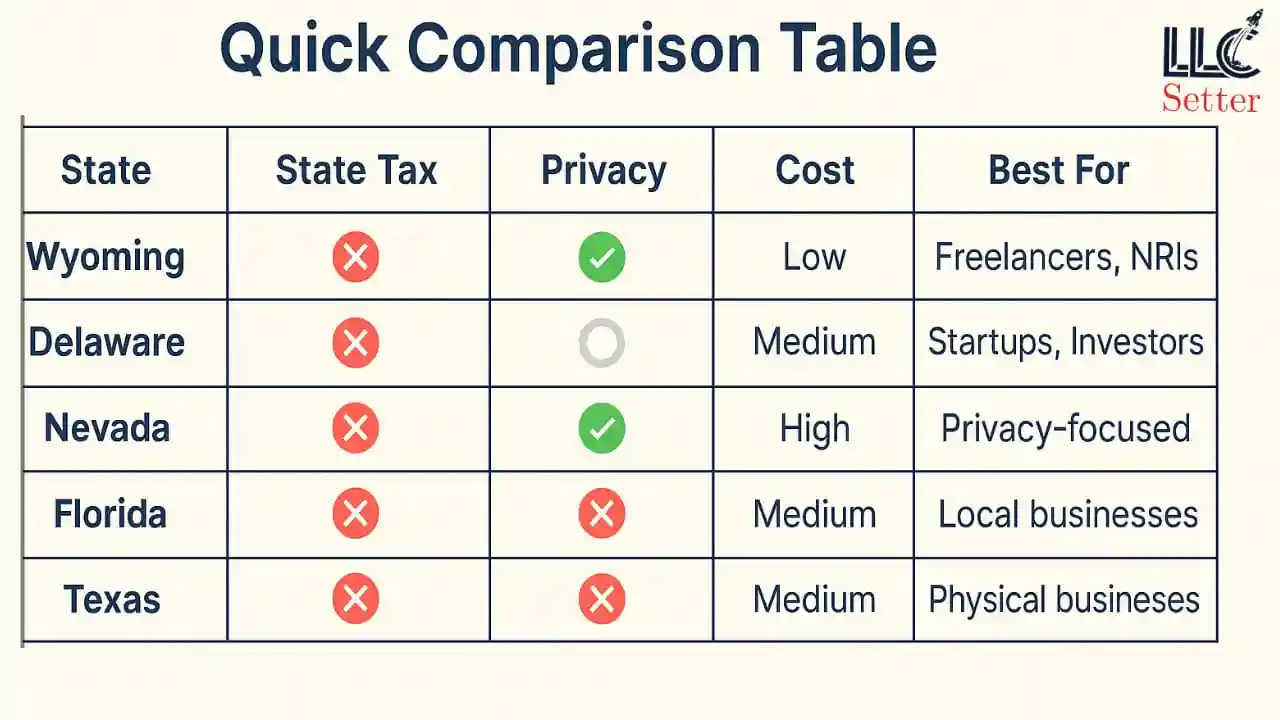

Best States to Create an LLC in the USA

1. Delaware

- Most business-friendly laws

- No obligation to publish member names

- Best for investors and tech start-ups

- Allows Series LLCs

How to form an LLC in Delaware: step by step guide

2. Wyoming

- No corporate or individual income tax

- Low yearly fees

- Allows anonymous ownership

- Best for asset protection

3. Nevada

- No state income tax

- Good privacy statutes

- Pro-business legal environment

4. Texas

- No personal income tax

- Large business and economy market

- Franchise tax is applicable

7 Best Advantages of forming an LLC in Texas

5. Florida

- No personal income tax

- Perfectly well-suited for property and tourist businesses

- Allows Series LLCs

6. South Dakota

- No income tax

- Strong asset protection laws

- Business-friendly state

7. Alaska

- No state sales tax

- Special advantages for natural resource businesses

What If You're Not a U.S. Citizen?

- You can still form an LLC in the United States even if you are not an American citizen.

- You'll have to seek Form SS-4 for an EIN (Employer Identification Number).

You may need a registered U.S. agent and mailing address.

- It may be challenging to open a U.S. bank account without appearing in person.

- There is no S Corporation option for non-residents.

- Comply with international taxation rules (e.g., FATCA).

- Make sure your visa permits business activity (if you're conducting the LLC from inside the United States).

15 Common mistakes to avoid when naming your LLC

Conclusion

Forming an LLC is most Powerful step and the most powerful move is choosing a right states to form an LLC, if you want to start US LLC don't take stress! LLC Setter makes it easy at affordable price with Tax compliance

start your LLC right now

Need help to choosing the right state?

talk to an expert today: +91 7370822354