US Company Registration for Indian Freelancers: Pros, Cons & Costs Explained

The definitive, humorous but informative guide to getting Indian freelancers to the world without ever leaving their seats.

Whether you're an Indian freelancer — perhaps a designer, developer, writer or online marketer — you're probably likely to have asked yourself at some point:

"Gee, I hope I can pick up more US clients… perhaps one day even have a US company!"

It does sound ambitious, doesn't it? That shiny "LLC" besides your business name, USD acceptability, and instant credibility from US buyers.

But don't go get the chai and forms just yet

An Indian freelancer having a US company can be a complete game-saver — or an expensive overkill.

This blog is going to break down each and every detail you want to know — the pros, the cons, the price, step-by-step guide, FAQs, and even some jokes (since taxes already are that dull).

US company register India, US LLC for Indian freelancers, register US company from India, US company cost for Indian freelancers, advantages of US LLC India, etc.

Okay, let's dive in

What is "US Company Registration" for Indian Freelancers?

For an Indian freelancer, having a US company simply amounts to having a legal US business entity — usually an LLC (Limited Liability Company) — while you stay behind in India to live and work.

Why folks do it:

- You can legally accept USD payments from US clients directly.

- You get access to US payment gateways like Stripe, PayPal US, etc.

- It enhances trust and credibility — "US-based business" sounds international and credible.

- It’s a step toward international scaling — without physically moving abroad.

Basically, you’re saying to the world:

“Yes, I’m in India, but my business is global.”

Pros of Registering a US Company as an Indian Freelancer

Here’s the exciting part — all the good stuff that makes people go “Whoa, I’m doing this tomorrow!”

✅ 1. Instant Credibility & Global Branding

Nothing impresses a client quicker than to see "LLC" by your name.

"Freelance Marketer" is fine. But "Skyline Media LLC, USA"? Pro stuff.

Registering in the US projects professionalism, reliability, and commitment — all essential when approaching high-paying US clients.

✅ 2. Cleaner USD Payments (and Less Conversion Agony)

- Indian freelancers usually have to bear with delays, conversion losses, and platform limitations when receiving payments in USD.

- With a US company, you can:

- Get a US bank account (direct or through fintech's like Mercury, Wise, etc.)

- Get paid using Stripe US, PayPal US, or ACH transfers

- Hold your money in USD and choose when to exchange

- No more bawling over ₹-₹ conversion losses.

✅ 3. Increased Access to World Clients & Tools

Few US clients and SaaS tools handle US entities only.

Having a US business opens up the following opportunities:

- Global freelancing agreements

- US-only business software

- Marketplace agency relationships or partnerships

- It's like having the VIP pass for freelancing.

✅ 4. Tax Optimization Opportunities (Legally!)

- While you will still be paying Indian taxes as a resident, a US LLC gives you flexibility to structure profit, bill it, and re-invest it.

- For serious pros or small agencies expanding, this can be a great move — if done with advice.

- (Disclosure: Don't try to "outsmart" the two governments. They always will.read more... LLC Tax Filing Requirement: for Non-US Citizen (Updated 2025)

✅ 5. Build a Real Global Business — Not Just a Gig

When you incorporate a company abroad, you start acting like an entrepreneur, not a freelancer any longer.

You can:

- Hire employees or freelancers

- Offer retainer services

- Grow the business

- Even get investors someday

- It's the first step from "solo hustler" → towards "global entrepreneur."

⚠ Drawbacks of US Company Registration for Indian Freelancers

Now, after you begin referring to yourself as "CEO of XYZ LLC," let's discuss the not-so-sexy aspects — the elements most YouTube videos gloss over.

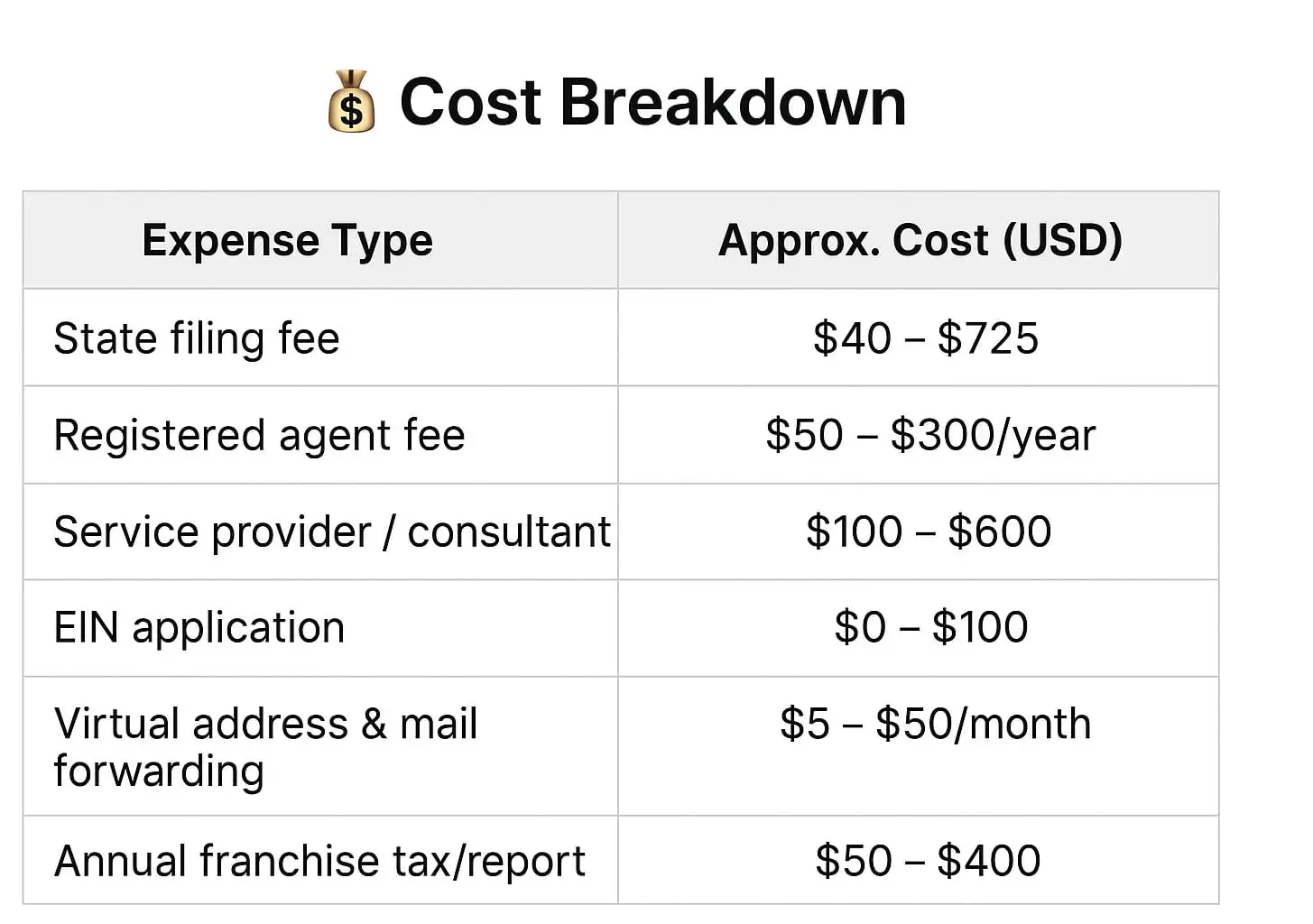

1. Setup and Maintenance Fees

Creating a company in the US isn't inexpensive. You'll be paying for:

- State filing fees: $40 to $725 depending on the state

- Registered agent fees: $50–$300 per year (required)

- EIN application or service fees: (sometimes free, sometimes $100+

- Mail forwarding or virtual address: $5–$50/month

- Annual reports & taxes: approximately $100–$400 annually

- So about: $300–$600 setup + $100–$400 annually = not cheap for starters.

- If you make $2,000/month, okay. But if you make $200/month — it's too expensive.

2. Dual Compliance (US + India)

Yes, the "fun" part — paperwork!

As an Indian resident, you still must:

- Report your foreign income in India

- Be compliant with FEMA (Foreign Exchange) and RBI regulations

- Coordinate "Place of Effective Management (POEM)" — if your US business is managed from India, it might be considered an Indian business for tax purposes

- So no, having a US LLC does not mean you're exempt from Indian taxes. Good try, though.

3. Bank Account & Payment Gateway Issues

- Even with a US entity, some banks won't take applications unless you're present in person.

- Despite the ease of fintech offerings such as Mercury, Wise, or Relay,

- delayed verification does take place.

- And yes — Stripe will be very glad to bring you on board… after you've sent them enough paperwork to start a mini library.

4. Might Be Overkill for Freelancers on a Small Scale

- If you have 1–2 clients or make less than ₹5-6 lakhs annually, the cost and complexity might not be worth it.

- Instead, scale first in Indian cars (such as a sole proprietorship or OPC).

Cost Breakdown (Transparent & Realistic)

Here's an example that makes sense — lawyer-talk free.

Total first-year cost: ~$400 – $800

Ongoing yearly cost: ~$150 – $500

So, if you're earning $10k+ per year freelancing → good choice.

If you're at $1k/year → wait awhile.

Step-by-Step: How to Register a US Company from India

Now let's walk through the actual roadmap — chai-proof, transparent, and simple. ☕

Step 1: Select the Right Structure

You will have two broad options:

- LLC (Limited Liability Company) → simple, easy to modify, best for freelancers.

- C-Corporation → best if you are raising funds or have investors (overkill for solo freelancers).

- The majority of Indian freelancers opt for LLC due to simplicity and low maintenance.

Step 2: Select the Right State

Top freelancer-friendly states:

- Wyoming: Low fees, no income tax, simple setup.

- Delaware: Suitable for startups/growth, but higher franchise tax.

- New Mexico: Low cost, low disclosure.

- both states have their advantages — but Wyoming is best for individual freelancers.

- read more...

Best states to start an LLC in US: 2025 Guide

Step 3: Get a Registered Agent

- US citizens do not require a registered agent, but non-US citizens must have one — someone (or a company) that gets legal mail in your place.

- Most agencies such as Firstbase.io, Start Global, or Stripe Atlas offer this service.

Step 4: Submit the Formation Documents

- Submit your Articles of Organization online with the Secretary of State (for LLCs).

- Once approved, well done — you now own a US company!

You'll get:

Certificate of Formation

LLC Agreement / Operating Agreement

Step 5: Get EIN (Employer Identification Number)

- EIN = Your company tax ID (similar to a PAN for US entities).

- You can directly apply through the IRS website (Form SS-4) or let your service provider apply.

- Processing time: 1–3 weeks for foreign applicants.

Step 6: Open a US Bank Account

With your documents (LLC documents + EIN + passport), you're ready to open an account with:

- Mercury Bank (best for non-US founders)

- Wise Business Account

- Relay or Pioneer Global Account

- No need to fly to the US — most can be done online.

read more...How to Open US Bank Account For LLC As Non-US Resident [2025 Updated]

Step 7: Indian Compliance

You'll need to:

- Report foreign earnings on your Indian ITR.

- Check FEMA/ODI rules if investing individually.

- Consult a CA to prevent "double taxation."

Step 8: Annual Compliance

Yearly, file your state annual report + registered agent renewal + clean books.

That's it — global empire, sustained.

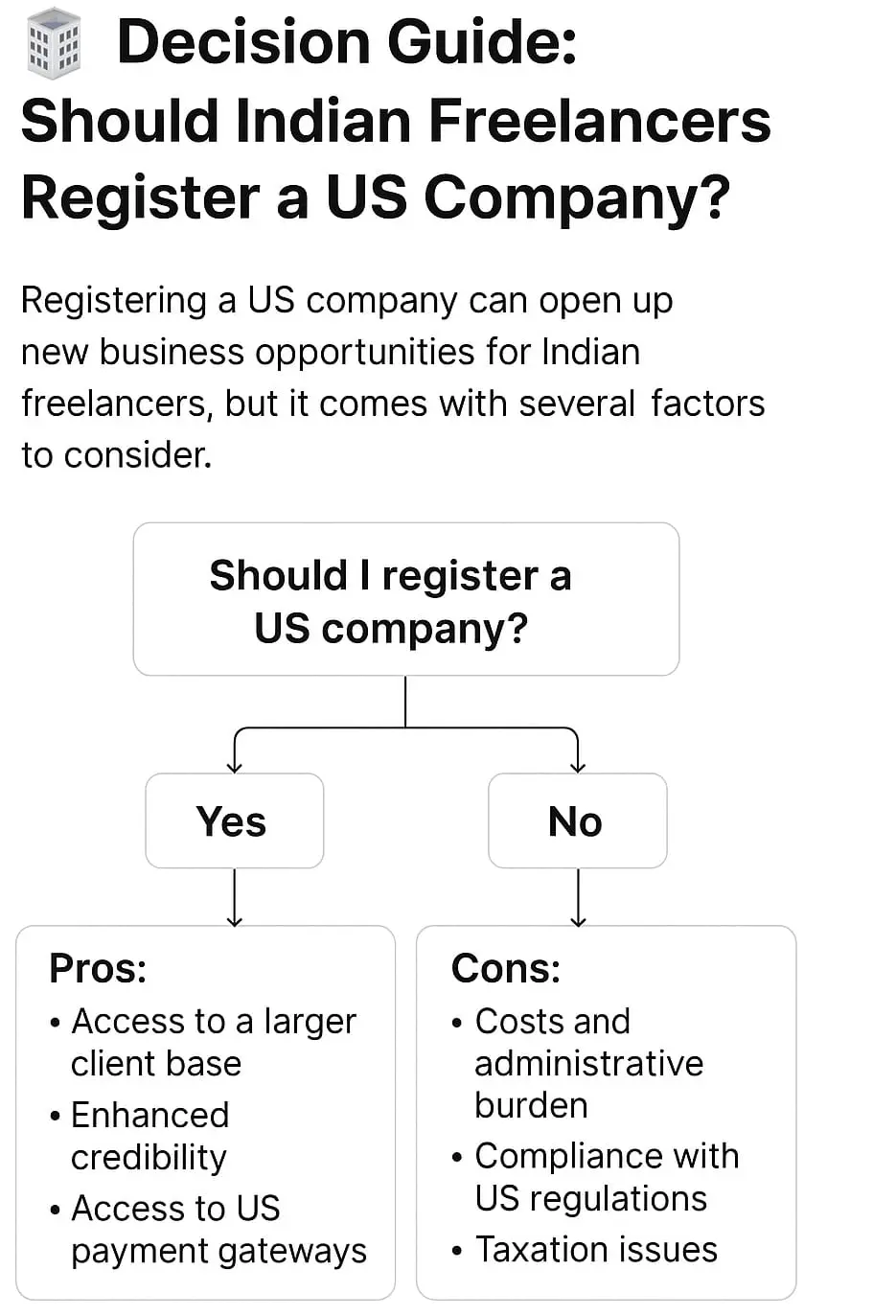

⚖ Decision Guide — Should You Do It?

Situation\ to for a US Company\Maybe Wait

Briefly:

If you are scaling → do it.

If you are still testing → relax.

Real Tips from Experience

Tip 1: Make use of Wyoming or Delaware for convenient setup.

Tip 2: Use platforms like Start Global, Firstbase.io, or Stripe Atlas — saves your time.

Tip 3: Never overlook year-end renewals or tax returns — the US government remembers for a long time.

Tip 4: Maintain Indian freelancing and US LLC finances separately.

Tip 5: Consult a CA well-versed in Indian and US legalities.

The Climax: Worth It?

So should you incorporate a US company as an Indian freelancer?

✅ Yes — if you're serious, expanding, and pursuing global clients.

❌ Not yet — if you're small-scale, exploring, or just curious.

Imagine it like going from bike to car.

If you've got the road (clients, income, goals), do it.

If you're learning how to ride, no Ferrari buying just yet.

Final Takeaway

- Registering a US company in India can unlock:

- Global credibility

- USD payments

- Access to top-notch clients and tools

- A doorway to becoming a full-fledged entrepreneur

But with that comes:

- Money

- Time

- Regular compliance

Do the math → talk to a CA → then go big or go home.

Because let's get real — it sounds 100× better to say "I run a US-based LLC" rather than "I freelance from my bedroom."

FAQs

Q1: Can an Indian freelancer actually register a US company?

Yes. You needn't be a US citizen or even travel to the US. Many Indian freelancers already have US LLCs operated remotely.

Q2: Will I be taxed in the US AND India?

Not necessarily. If you receive no "US-source income," you won't be liable for US taxes — but as an Indian tax resident, you'll be taxed on worldwide income by India.

(Yes, the CA will still receive your money. ????

Q3: What happens if I don't comply?

Stupid simple — you'll get fines, late charges, and perhaps lose "good standing" status. That is: your LLC becomes invisible. ????

Q4: Do I need a US phone number and address?

Nope. Your registered agent and virtual address service take care of that.

Q5: Which state do I use — Delaware, Wyoming, or New Mexico?

For most Indian freelancers: Wyoming wins.

Low cost, privacy, no income tax, easy to maintain.

LLC SETTER PROVIDE

Begin that world dream. and form your LLC with LLC setter with 50% discount and transparent price