How to Reduce Taxes for LLC in USA – Step-by-Step Entrepreneur Guide

Having an LLC in the USA is a good way to have freedom, legal protection, and tax advantages — if you know how to play the tax game and claim the proper deductions. Most entrepreneurs pay more taxes than they have to simply because they don't take the time to plan ahead.

In this step-by-step guide, we will explain functional and legal means of paying lower taxes in your LLC, how to organize your finances to avoid unwanted liabilities, and what the IRS really allows.

1. Understand How LLC Taxes Work

You need to know how your LLC is taxed before cutting taxes. By default:

- Single-member LLC → taxed as a sole proprietorship (income passes through to your personal tax return).

- Multi-member LLC → treated as a partnership (profits and losses allocate to members).

You may, however, choose to be treated as an S Corporation or a C Corporation using IRS Form 2553 or Form 8832. This can significantly change your tax rate and deduction opportunities.

Pro Tip: If your LLC generates over $60,000 of net profit per year, choosing S Corporation status typically reduces self-employment taxes.

2. Choose the Right State for Your LLC

Your state of residency affects your taxes. There are some states that don't collect state income tax:

- Florida

- Texas

- Wyoming

- Nevada

- South Dakota

If you're based in any of these states, you can avoid paying state-level income taxes. If your operations, however, are elsewhere, you will still pay taxes there.

READ MORE.... 9 tax free states to start US LLC

3. Claim All Legitimate Business Deductions

The easiest method to minimize taxable income is to delete all of the business expenses allowed by the IRS. Some common deductions for LLC owners are:

- Rent or home office expenses

- Utilities and internet fees

- Business travel (flights, hotels, meals – within IRS limits)

- Software subscriptions

- Advertising and marketing

- Professional services (attorney, accountant, consultants)

- Employee wages and contractor fees

IRS Rule: Expenses must be ordinary (the norm for your business) and necessary (help your business operate).

4. Take the Home Office Deduction

If you work from home, the home office deduction can save you hundreds or thousands of dollars a year.

You can claim:

- A portion of your rent or mortgage interest

- Utilities (electricity, water, internet)

- Maintenance and repairs for your workspace

Tip: You can use the simplified approach ($5 per square foot) or the actual cost approach (figure percentage of house utilized for business).

5. Deduct Your Health Insurance Premiums

- If you are self-employed and buy your own health insurance,

- you can deduct your full premiums for yourself, spouse, and dependents.

- This is regardless of whether you are itemizing deductions.

6. Hire Your Family Members

- Hiring your spouse or children for actual services will reduce your taxable income. For example:

- Pay your teenage child for social media marketing or administrative help.

- Wages you pay are tax-deductible to your LLC.

- If the child earns under the standard deduction limit, they can pay zero income taxes.

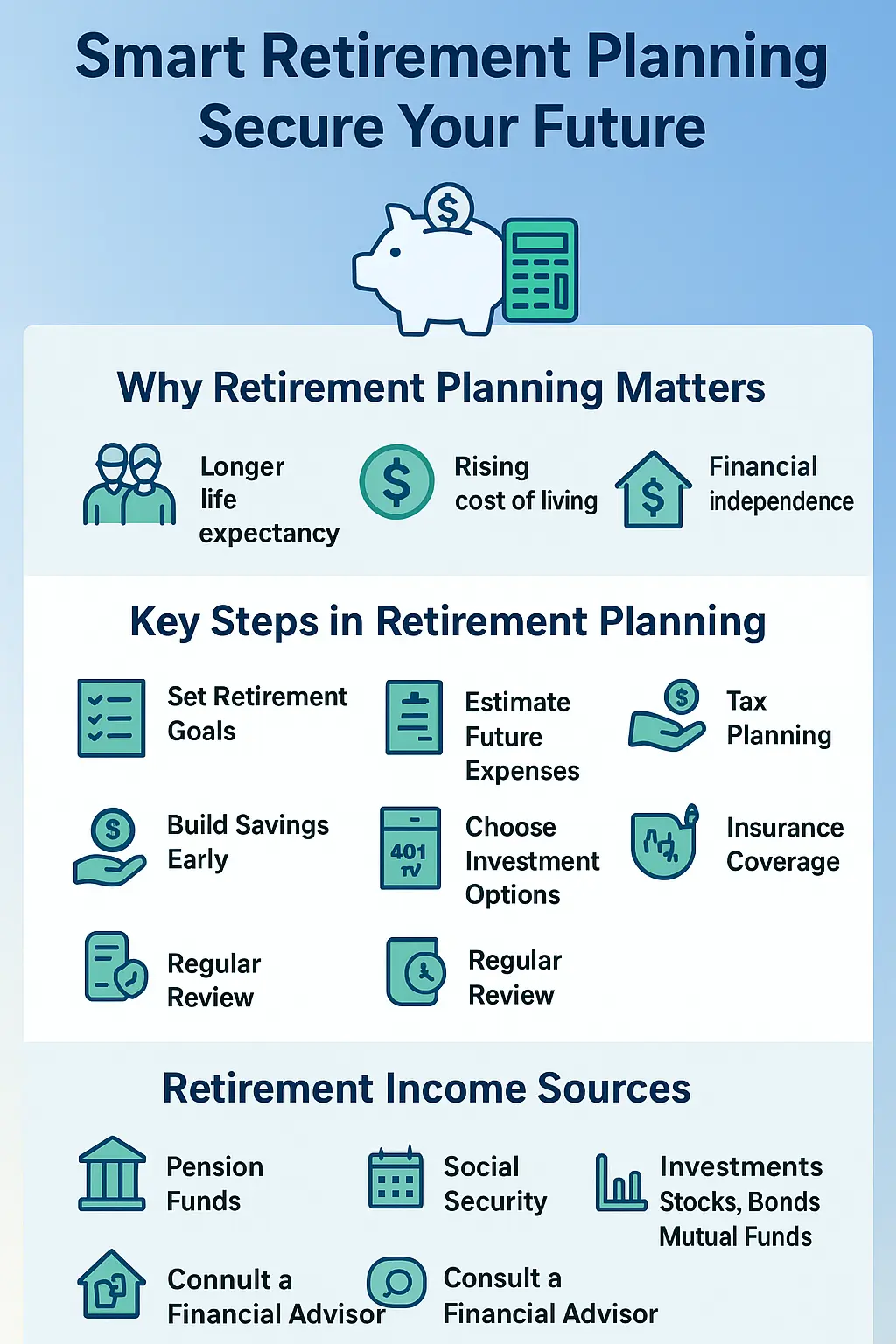

7. Create a Retirement Plan

Retirement savings through retirement account contributions helps you in two ways: saves for the future and reduces taxes today. Among the most favorite of the LLC owners are:

- SEP IRA – Contribute income up to 25% (up to $69,000 in 2024).

- Solo 401(k) – Contribute as employer and as employee (total $69,000).

- Donations are tax-deductible, lowering your income taxed today.

8. Take Advantage of Depreciation

- When you buy equipment, vehicles, or real estate for your LLC, you can depreciate part of their cost each year.

- On some assets, you can even depreciate the entire cost in the first year with Section 179.

Example:

Buying a $40,000 delivery van → Depreciate whole $40,000 in the first year (if qualified) → Huge tax savings.

9. Track All Your Expenses with Software

Missing receipts are missing deductions. Take advantage of accounting software like:

- QuickBooks

- FreshBooks

- Xero

These software connect to your bank accounts and automate expense categorization, which makes tax time easier and more accurate.

10. Pay Estimated Taxes

- Failing to pay taxes on a quarterly basis may result in penalties and interest.

- Paying estimated payments every quarter saves you from IRS penalties and helps manage cash flow planning.

11. Consider S Corporation Election

If your LLC earns a lot of profits, S Corporation election can save self-employment tax.

Example:

LLC as sole proprietorship: Pay 15.3% self-employment tax on entire profit.

S Corp election: Pay yourself reasonable salary (taxable as self-employment income) and take the remainder as distributions (not subject to self-employment tax).

12. Talk to a CPA or Tax Advisor

Tax laws change every year, and a single small mistake can cost you a lot. An experienced CPA with a background in small businesses and LLCs can help you:

- Determine you didn't know about

- Choose best tax structure

- Prepare paperwork correctly

- Obey IRS rules

13. Avoid These Common LLC Tax Mistakes

- Mixing personal and business expenses

- Not keeping proper documentation

- Not meeting deadlines

- Forgetfulness about state-level taxation

- Failure to listen to quarterly estimated payment

Final Thoughts

There needs to be the payment of taxes, but overpayment is not obligatory. Saving on taxes legally for LLC in USA will enable you to have more money within your business to use for expansion. Forward planning, keeping accurate records, and making the most of all the available deductions and allowable structure is the answer.

Your tax plan for your LLC must be reviewed annually because tax law and your income change over time. Even minimal changes — like electing S Corp status or classifying expenses more efficiently — can reduce thousands of dollars a year.

Ready to Slash Your LLC Taxes?

Here at LLC Setter, we help entrepreneurs structure, organize, and maximize their LLCs for maximum tax savings — all 100% lawful and IRS-compliant.

Call now and schedule your Free Consultation to discover just how much you can save this year.