How to Register a US LLC from India:

You will learn How to register a US LLC from India. LLC setup is available at a very low cost for non US residents Thinking of taking your business global?

Forming a Limited Liability Company (LLC) in the United States could be your smartest move yet. For Indian entrepreneurs, setting up a US LLC not only opens doors to one of the world’s largest economies, but also:

boosts your brand credibility.

provides robust legal protection.

Opening a company in the us is a smart move, but registering an LLC from India can be tricky without the right guidanc In this step-by-step guide, you will learn how to register a US LLC from India if you are an entrepreneur, or an e-commerce merchant from India. Expand your business with LLC SETTER- we simplify the LLC formation process for Indian entrepreneurs.

Why Start a US LLC from India?

1. Global Market Access

Having a US LLC provides you with a direct entry point to the American market—over 330 million consumers, endless business opportunities and higher chances of success.

2. Increased Business Credibility

A US-registered company establishes instant credibility with global clients, partners, and investors. It communicates that you're serious and trustworthy.

3. Protection of Limited Liability

An LLC safeguards your personal assets by keeping them separate from your business liabilities. If the business is sued or gets into debt, your personal savings, home, and belongings remain safe.

4. Tax Flexibility

LLCs benefit from pass-through taxation, i.e., profits are taxed once at the owner's level. Also, US-India tax treaties help minimize double taxation for Indian residents.

5. Easy and flexible compliance

Fewer formalities compared to corporations—no required board meetings or complex filings.

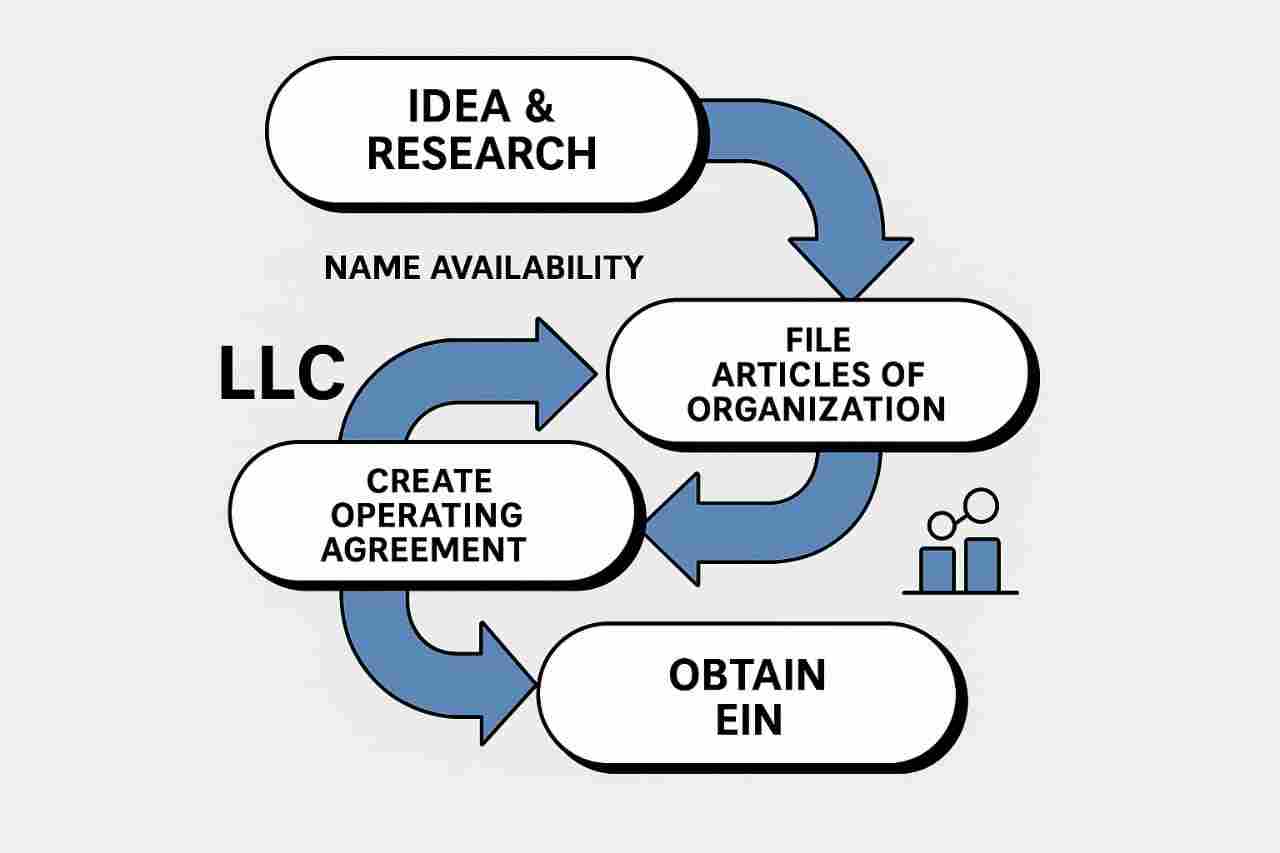

How to Register a US LLC from India: step- by- step guide

At LLC SETTER, we make it easy to form a US LLC for Indian entrepreneurs. Here's the process:

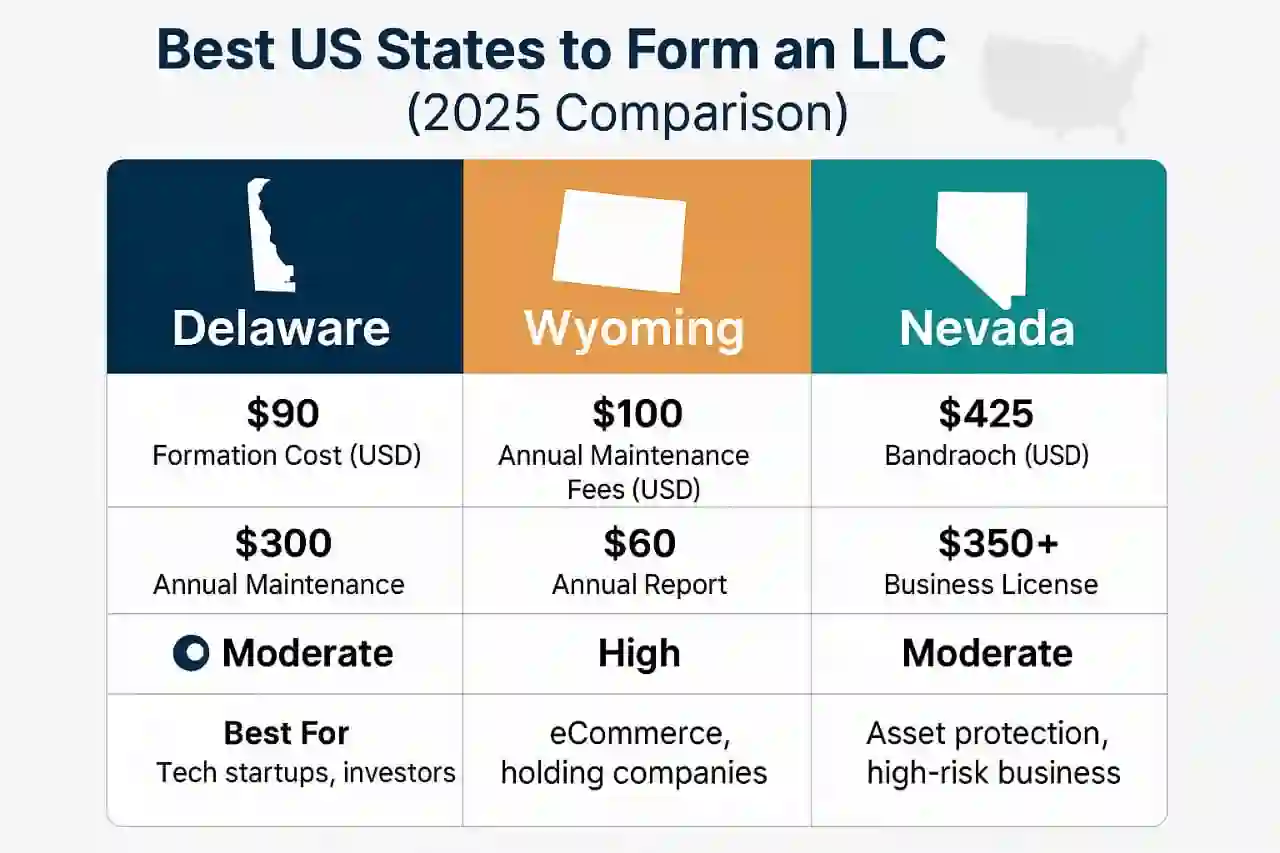

Step 1: Select the Correct State

Popular states for non-residents are:

Delaware: Business-friendly laws

Wyoming: Low costs and privacy advantages

Nevada: Powerful asset protection statutes

Each state has varying rules and fees, so select carefully depending on your intentions.

Step 2: See our pricing

See our Pricing Page to view plans side by side. We provide low prices with high- quality service.

Step 3: Complete the Registration Form

Complete basic business information—your business name, purpose, and member details. It's a fast and easy process for beginners.

Step 4: Place Your Order

After your form is ready, place your order. We'll take care of all the files, paperwork and also processing.

Step 5: We Will Obtain Your EIN

You'll require an EIN to open a US bank account, file tax returns, and hire staff. We help you obtain this straight from the IRS.

Step 6: Open a US Bank Account

It's easy to receive payments, particularly if you work with US clients or companies like Amazon or Stripe.

Why LLC Setter?

All-in-One Service: From LLC setup to EIN and bank account assistance- we cover it all.

1. Transparent Pricing: No hidden fees—everything is on the list from the beginning.

2. US Compliance Professionals: We see that your company is properly established in accordance with US regulatory mandates.

3. Designed for Indian Founders: Our services are tailored for Indian founders growing internationally.

Key Tax and Compliance Reminders

1. US Taxes for Indian Owners

You might be required to file US taxes if your LLC generates income from US sources. Always seek the advice of a qualified tax professional.

2. Annual Compliance

Certain states have annual reports or franchise taxes. We assist you in staying current so that you stay in good standing.

Common Pitfalls to Steer Clear Of

Choosing the Wrong State: Every state has different tax regulations. Research or seek professional assistance before making a choice.

Missing the EIN: Your LLC isn't complete without this an EIN. It's required for opening a bank account and staying compliance.

Ignoring Ongoing Filings: LLCs need to remain compliant with annual reports and fees—don't ignore this.

Failing to Consult a Tax Professional: A skilled CPA can help you avoid unexpected tax liabilities and guarantee cross-border tax optimization.