How to Form an LLC in Delaware – Step by Step guide

Delaware is an America pro-business state and the go-to choice for entrepreneurs looking to incorporate an LLC. A U.S. citizen or non-resident, forming an LLC in Delaware is an easy, hassle-free process.

a LLC in Delaware (Limited Liability Company) it is most flexible business structure formed under Delaware state low. it is help to protect your personal stuff-like your car and your house as well as. if your business gets into trouble. most of the people select Delaware because of rules there are good for businesses, and you don't have to share your name publicly. it is simple process, also flexible. want to know about why choose Delaware visit https://www.corp.delaware.gov

How to register US LLC from India?

Follow the step-by-step instructions below.

Why Delaware For Your LLC?

- No tax on goods and services.

- Powerful business court and independent judiciary.

- Respects confidentiality — owners are not revealed.

- Worked for blue chips and start-ups.

Step 1: Select a Name for Your LLC

Your name for your LLC will be distinct and won't be available to any other company in Delaware.

- It will have to include the words "Limited Liability Company" or abbreviations such as "LLC" or "L.L.C."

- Make sure it is easy to remember and has your image.

Step 2: Select a Registered Agent

Registered Agent is the individual or firm who receives legal notices on behalf of your LLC.

Requirements:

- Must have a Delaware street address.

- Must be accessible during business hours.

- You may hire registered agent services or name an individual you personally know in Delaware.

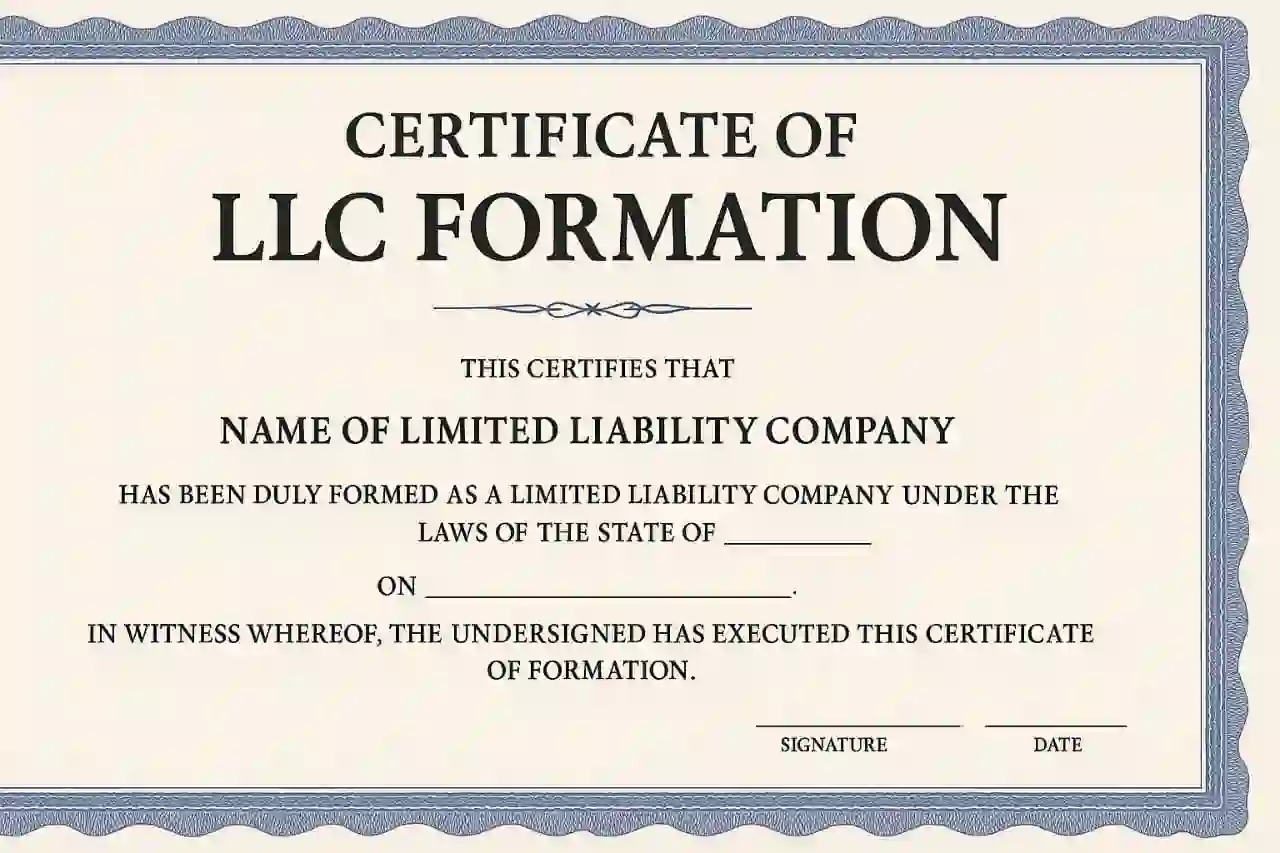

Step 3: File the Certificate of Formation

This is the formal document which creates your LLC in Delaware.

Information required:

- Name of your LLC

- Name and address of registered agent

- Filing Options: Mail or online

- Filing Fee: $90 (adjusted for inflation)

- Processing 3–4 business days (normal) to same-day (for extra charge).

EXAMPLE;

Step 4: Choose an Operating Agreement

Not a legal-requisite document, but strongly suggested. Describes inner dynamics of your LLC.

Includes:

- Ownership arrangement

- Division of profit and loss

- Managerial positions

- Voting and decision-making process

- This agreement avoids internal conflicts and legitimizes your LLC.

Step 5: Obtain an EIN (Employer Identification Number)

EIN is like a Social Security Number for your business and is issued by the IRS.

You’ll need it for:

- Opening a business bank account

- Hiring employees

- Filing taxes

- This is a mandatory step and completely free when done directly through the IRS.

Step 6: Comply with Delaware’s Annual Requirements

All Delaware LLCs are required to:

- Pay an annual Franchise Tax of $300

- Pay by June 1 each year

- No annual report is needed if you're creating an LLC (not corporations).

Optional: Open a Business Bank Account

Opening a business bank account is needed to keep personal and business money separate.

You'll need:

Certificate of Formation

Operating Agreement

- EIN letter from IRS

- Valid ID or passport (for non-residents)

- Choose a bank most convenient for you and with international founders if you're not in the U.S.

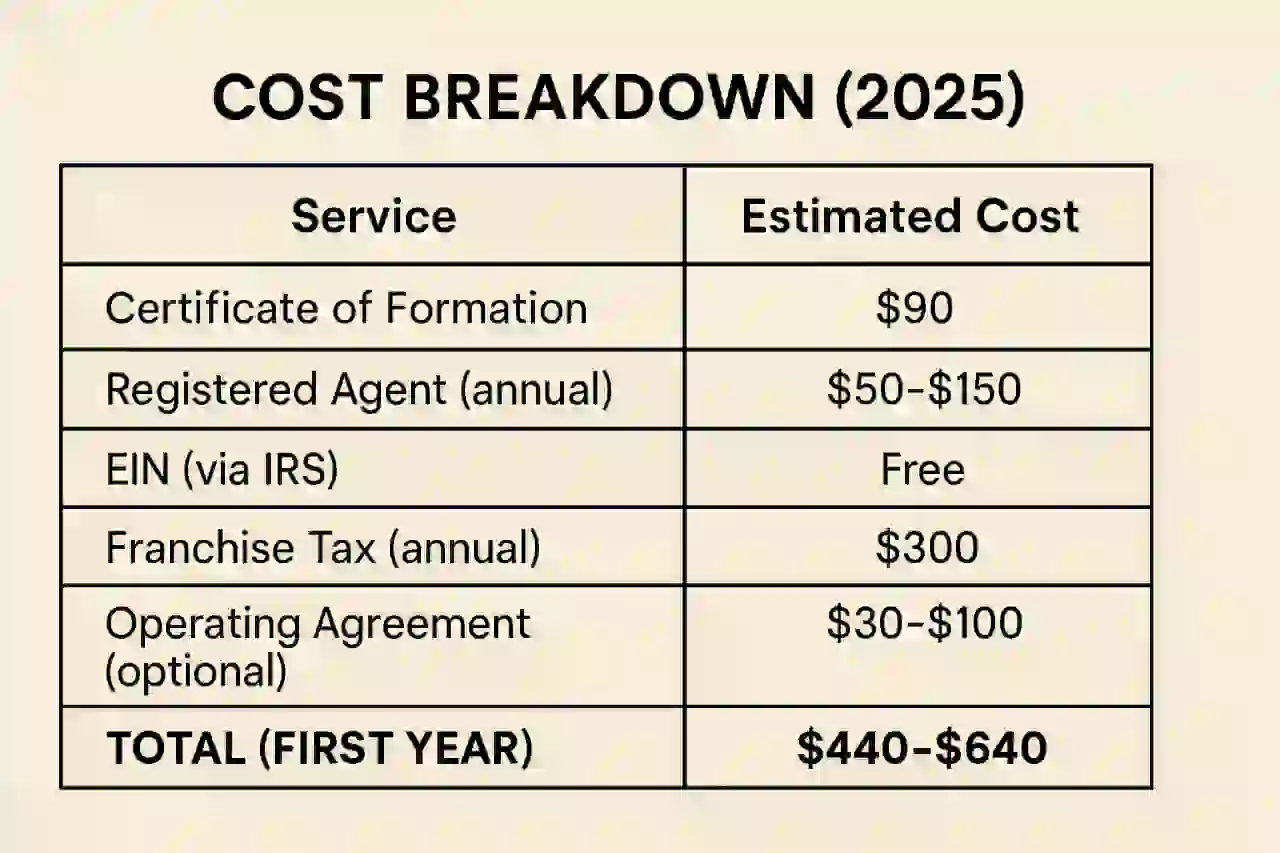

Cost Breakdown (2025)

Here's a step-by-step breakdown of the approximate cost of forming an LLC in Delaware:

9 Best tax-free states to form a US LLC: in-depth guide

Conclusion

Delaware provides the optimal combination of legal protection, anonymity, and flexibility — the perfect place to form your LLC. As an entrepreneur beginner, freelancer, or global entrepreneur, forming an LLC here can be the smart thing to do.

So if you're ready to begin, start now and build your business the right way.

It doesn't have to be that hard to form an LLC in Delaware

Let LLC SETTER do the paperwork, compliance, and filing—while you focus on taking your venture public.

Quick, Affordable & Effective LLC Formation Services.

Begin Today | Call Today

FAQs – Forming an LLC in Delaware

Q1. Can non-US residents form an LLC in Delaware?

Yes! Delaware allows foreigners to form LLCs. You do not need a U.S. visa or residency.

Q2. Do I need a U.S. address to start an LLC?

No, but you need a Delaware Registered Agent with a U.S. address.

Q3. Can I use a virtual address?

Yes, for your business correspondence — but not as your registered agent address.

Q4. Is an LLC in Delaware suitable for online business or eCommerce?

Absolutely. Delaware is a great choice for online entrepreneurs due to its flexibility and privacy.